Our Solutions

Save up to 30%* more with Hartree Solutions

Gas Generation

Save up to 30%* more with Hartree Solutions

Gas Generation

An intelligent anchor technology to help you achieve sustainability

The returns from sustainable energy technologies can be slow to come – up to 20 years in some cases.

Understandably, not all commercial or industrial businesses can afford to wait for the gains, even though they want to transition to green power as soon as possible. That’s where a hybrid solution using gas generation as an anchor comes into its own.

Reciprocating gas engines and gas turbines

We invest to provide reciprocating gas engines or gas turbines as energy solutions to anchor alongside sustainable technologies, such as solar and wind. This combined approach can bring large financial savings to your organisation and accelerates the transition to green technologies sooner than you might otherwise be able to do with your own capital.

Hartree currently owns and operates a portfolio of 50MW of gas generation across 7 sites with another 3 sites going into construction in 2020, this has given us a great insight of how best to maximise the revenues from this technology and improve savings for our clients

Energy market insights and news

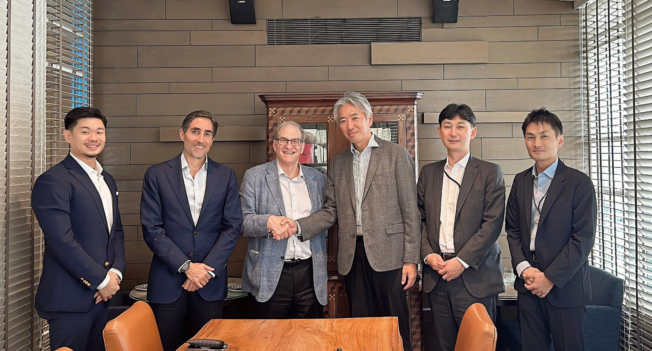

Hartree Partners Announces Ten-Year Carbon Credit Agreement with Kansai Electric Power Group

Singapore, 14 August 2024: Hartree Partners (“Hartree”) today announced that it has signed a ten-year…

Singapore, 14 August 2024: Hartree Partners (“Hartree”) today announced that it has signed a ten-year agreement with Kansai Electric Power Group (“Kansai Electric”), enabling Kansai Electric access to high-integrity carbon credits in Australia. The agreement expands the companies’ partnership, first announced 14 December 2023, and will support Kansai Electric’s Zero Carbon Vision.

Ahmed S Al-Awa, Managing Director of Hartree Partners Singapore Pte. Limited, said, “Hartree is deeply committed to the Japanese carbon market, and we are excited about the opportunity to expand our presence, drive sustainable solutions and support our partners to help achieve Japan’s national net zero targets.”

About Hartree Partners

Hartree Partners, LP is a leading global merchant commodities firm specializing in energy and associated industries. Established more than 25 years ago and jointly owned by senior management and funds managed by Oaktree Capital Management, L.P., Hartree has a unique 25+ year track record in proprietary trading and investing in energy markets across the globe. Hartree’s core strengths are understanding the complexities of the global commodity market and risk pricing and converting that knowledge into consistently successful trading strategies. Today, the firm has over 700 employees and a further approximately 1,000 associates in its operating companies and a strong balance sheet available for trading and principal investment purposes. For more information, please visit www.hartreepartners.com

Kansai Electric Power Group and Hartree Partners sign first term contract in Japan coupling LNG supply with carbon investments.

Japan, 14th December 2023: Japanese power company, Kansai Electric Power Group (Kansai Group), has signed…

Japan, 14th December 2023: Japanese power company, Kansai Electric Power Group (Kansai Group), has signed a binding term agreement with Hartree Partners for the supply of LNG alongside investment in a nature-based carbon project in Australia, the first deal of its kind in Japan. The deal represents Kansai Group’s long-term commitments to decarbonisation and the provision of low-carbon energy for its customers.

This LNG supply agreement enables KE Fuel Trading Singapore Pte. Ltd (KEFTS) to grow its LNG portfolio which will support Kansai Group’s LNG supply-demand situation and customers around the globe.

Also, through its expertise in global carbon markets and its project portfolio in Australia, specifically focused on nature restoration, Vertree Partners, Hartree’s global carbon market arm, will support The Kansai Electric Power Co., Inc. (Kansai Electric) to access future supply of high-integrity carbon credits to support its Zero Carbon Vision.

Both companies will explore potential opportunities to support Japan’s national net zero targets in areas such as LNG, renewable energy, environmental products and carbon capture and storage (CCS).

Hartree Partners is a well-established global energy and commodities firm with decades of experience in the physical and financial energy and commodities market. Its wholly-owned subsidiary, Vertree Partners, is focused on decarbonisation and environmental markets.

“Carbon credits have an important role to play in realising a zero-carbon society,” said Hideaki Ikai, Executive Officer, Operation and Trading Division in Kansai Electric. “Kansai, as a leading company of zero-carbon energy, is proactively studying ways to create a carbon neutral society, and I believe that this collaboration with Hartree Partners will accelerate our activities to achieve the goal of carbon net zero by 2050.”

Shinichi Kudo, Chief Executive Officer, KEFTS, added “The combination of LNG and carbon credits will give us a promising option to attain our mission to provide our customers with stable energy supply and decarbonization solutions.”

Ahmed S Al-Awa, Managing Director of Hartree Partners Singapore Pte. Limited and a Partner of Hartree Partners, said “this forward-looking move by Kansai Electric Power Group sends an important signal that carbon markets are likely to become a key component of the natural gas/LNG value chain as the sector moves to decarbonise.”

Ariel Perez, Managing Partner of Vertree Partners added “We are committed to supporting Kansai Electric Power Group to make credible investment in the carbon market. The market is evolving rapidly, and companies may be increasingly exposed. Investments such as these support future preparedness whilst also directing finance to nature-based solutions, without which we face continued environmental degradation and eco-system loss and increase the risk of missing our global climate goals.”

About The Kansai Electric Power Co., Inc.

Kansai Electric Power Group, as a Japan’s leading electric power company, is aiming for carbon neutrality throughout the entirety of its business activities by 2050 to limit global warming, while increasing energy independence to secure energy supply for its customers, Kansai Group can be found at https://www.kepco.co.jp/english/

About KE Fuel Trading Singapore Pte. Ltd

KEFTS, a 100% subsidiary of Kansai Electric, was established as an LNG trading arm of Kansai Group in April 2017. KEFTS has been supporting Kasai Electric’s LNG supply-demand balance and providing LNG portfolio for customers around the globe, and now enhances its activity to support Kansai Group’s carbon neutrality at its base in Singapore.

About Hartree Partners

Hartree Partners, LP is a leading global energy and commodities firm with an international reputation for integrity developed over decades. Our expertise enables us to capitalise on the transition from fossil fuels to a low carbon economy. Hartree’s global breadth and reach provide a competitive presence in a comprehensive range of commodity markets, enriched by the firm’s employees who add deep insight, expertise and innovative thinking. More information concerning Hartree can be found at www.hartreepartners.com

About Vertree Partners

Vertree Partners enables leading companies and institutions to invest in both nature and innovative climate technologies to assist them in reaching their decarbonisation goals. Founded in 2020, Vertree is focused on driving positive environmental and social impact, and providing its customers access to existing and future supply of high-integrity environmental commodities. It does this through directly financing quality emissions reductions and removals projects; partnering with renowned project developers; investing in innovative organisations and technology-based solutions; and providing its expertise in voluntary and compliance markets, trading, market analytics and risk management. Vertree is wholly owned by Hartree Partners.