Our Solutions

Guaranteed savings with Hartree Solutions

Our Solutions

Guaranteed savings with Hartree Solutions

Fully Funded Solutions

Energy Freedom for All

We want to help create a marketplace where UK organisations of all sizes freely control their own energy agenda, increase their revenue, and contribute to a healthy planet – unconstrained by capital expenditure.

We created Hartree Solutions to provide energy saving solutions that allow companies of all sizes to focus their capital on their core business activities, whilst Hartree invests in the solution to improve energy costs and sustainability impact. We believe all businesses need to put the environment at the heart of their energy strategy and Hartree Solutions has the desire, will and expertise to enable this.

Hartree Solutions will make the investment in cutting-edge generation and storage technologies on behalf of your business, uniquely optimising these assets (using our innovative AI system) to reduce your energy costs, lower your carbon emissions and increase your business’s long-term competitiveness.

We optimise, so you save, not your energy supplier

Very few energy users have true access to the real-time energy market, with them missing the opportunity to optimise power generation based on real-time market prices with the energy supplier enjoying the cost benefits. Hartree Partners Supply, our fully licensed supply business, becomes your supplier, meaning that we can access and optimise all the real-time market benefits and guarantee long term savings to your benefit. Through our trading team, real-time optimisation, asset knowledge and a fully integrated supply business we can optimise generation suit your needs and deliver to you a saving on every kWh of power you use.

We are a leading global energy trader

Hartree, as specialists in the energy industry for over 20 years, has a deep understanding of all energy technologies as this is core to our business of understanding the market. We use trading and market intelligence to unlock technical opportunities for you and as we are completely independent, we can offer best in class solutions, whoever the manufacturer and whatever that technology may be.

We offer a single cohesive solution

To your energy needs based on three core principles:

Build – we create the right generation asset or combination of assets for your business

Own – we own the asset, which means zero upfront expenditure for you

Operate – our team uses its deep trading experience to maximise the savings produced by the asset and minimise the risks of market volatility. It is this unique approach that enables us to guarantee savings to you over the long term, savings that allow you to remain competitive and transition your business to a lower-carbon future.

Hartree Solutions believe in

Complete transparency

Each Hartree owned asset has its own trading account dedicated to your business. We give you insights and visibility of your energy data in real-time via our mobile app.

Never-ending innovation

The energy market and related technologies are constantly evolving. Because Hartree Solutions is independent, we are technology agnostic resulting in our being free to use the latest and best technology to help you stay competitive no matter the original equipment manufacturer. We provide you with a solution, not sell you a product.

Ethical decision-making

If something is not ethically sound, we will not do it. Our reputation, your reputation and the environment are paramount to us at Hartree Solutions. We will not compromise on these values.

Profitable partnerships

We strive to create a healthy working relationship with you, as your virtual team. We are not interested in one-sided transactions, but long-term wins together as partners.

Personal Service

Based in our London offices, our account management and customer care team will be available to assist you every step of the way, from a dedicated project manager ensuring the design & construction phases run smoothly to a named customer services advisor who will help you with any needs you may have during the operational phase, all our support teams are just a phone call or email away.

We help power your business in a way that keeps it profitable, competitive and contributes to a carbon neutral world.

Energy market insights and news

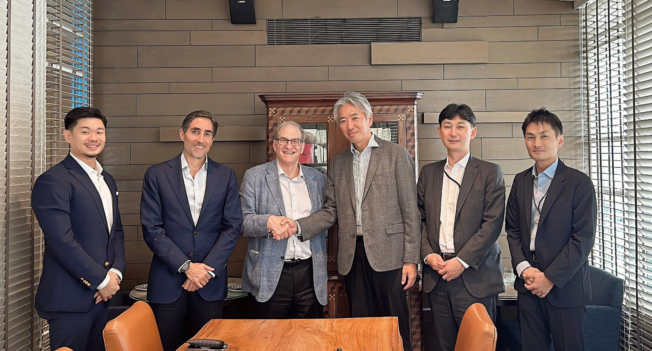

Hartree Partners Announces Ten-Year Carbon Credit Agreement with Kansai Electric Power Group

Singapore, 14 August 2024: Hartree Partners (“Hartree”) today announced that it has signed a ten-year…

Singapore, 14 August 2024: Hartree Partners (“Hartree”) today announced that it has signed a ten-year agreement with Kansai Electric Power Group (“Kansai Electric”), enabling Kansai Electric access to high-integrity carbon credits in Australia. The agreement expands the companies’ partnership, first announced 14 December 2023, and will support Kansai Electric’s Zero Carbon Vision.

Ahmed S Al-Awa, Managing Director of Hartree Partners Singapore Pte. Limited, said, “Hartree is deeply committed to the Japanese carbon market, and we are excited about the opportunity to expand our presence, drive sustainable solutions and support our partners to help achieve Japan’s national net zero targets.”

About Hartree Partners

Hartree Partners, LP is a leading global merchant commodities firm specializing in energy and associated industries. Established more than 25 years ago and jointly owned by senior management and funds managed by Oaktree Capital Management, L.P., Hartree has a unique 25+ year track record in proprietary trading and investing in energy markets across the globe. Hartree’s core strengths are understanding the complexities of the global commodity market and risk pricing and converting that knowledge into consistently successful trading strategies. Today, the firm has over 700 employees and a further approximately 1,000 associates in its operating companies and a strong balance sheet available for trading and principal investment purposes. For more information, please visit www.hartreepartners.com

Kansai Electric Power Group and Hartree Partners sign first term contract in Japan coupling LNG supply with carbon investments.

Japan, 14th December 2023: Japanese power company, Kansai Electric Power Group (Kansai Group), has signed…

Japan, 14th December 2023: Japanese power company, Kansai Electric Power Group (Kansai Group), has signed a binding term agreement with Hartree Partners for the supply of LNG alongside investment in a nature-based carbon project in Australia, the first deal of its kind in Japan. The deal represents Kansai Group’s long-term commitments to decarbonisation and the provision of low-carbon energy for its customers.

This LNG supply agreement enables KE Fuel Trading Singapore Pte. Ltd (KEFTS) to grow its LNG portfolio which will support Kansai Group’s LNG supply-demand situation and customers around the globe.

Also, through its expertise in global carbon markets and its project portfolio in Australia, specifically focused on nature restoration, Vertree Partners, Hartree’s global carbon market arm, will support The Kansai Electric Power Co., Inc. (Kansai Electric) to access future supply of high-integrity carbon credits to support its Zero Carbon Vision.

Both companies will explore potential opportunities to support Japan’s national net zero targets in areas such as LNG, renewable energy, environmental products and carbon capture and storage (CCS).

Hartree Partners is a well-established global energy and commodities firm with decades of experience in the physical and financial energy and commodities market. Its wholly-owned subsidiary, Vertree Partners, is focused on decarbonisation and environmental markets.

“Carbon credits have an important role to play in realising a zero-carbon society,” said Hideaki Ikai, Executive Officer, Operation and Trading Division in Kansai Electric. “Kansai, as a leading company of zero-carbon energy, is proactively studying ways to create a carbon neutral society, and I believe that this collaboration with Hartree Partners will accelerate our activities to achieve the goal of carbon net zero by 2050.”

Shinichi Kudo, Chief Executive Officer, KEFTS, added “The combination of LNG and carbon credits will give us a promising option to attain our mission to provide our customers with stable energy supply and decarbonization solutions.”

Ahmed S Al-Awa, Managing Director of Hartree Partners Singapore Pte. Limited and a Partner of Hartree Partners, said “this forward-looking move by Kansai Electric Power Group sends an important signal that carbon markets are likely to become a key component of the natural gas/LNG value chain as the sector moves to decarbonise.”

Ariel Perez, Managing Partner of Vertree Partners added “We are committed to supporting Kansai Electric Power Group to make credible investment in the carbon market. The market is evolving rapidly, and companies may be increasingly exposed. Investments such as these support future preparedness whilst also directing finance to nature-based solutions, without which we face continued environmental degradation and eco-system loss and increase the risk of missing our global climate goals.”

About The Kansai Electric Power Co., Inc.

Kansai Electric Power Group, as a Japan’s leading electric power company, is aiming for carbon neutrality throughout the entirety of its business activities by 2050 to limit global warming, while increasing energy independence to secure energy supply for its customers, Kansai Group can be found at https://www.kepco.co.jp/english/

About KE Fuel Trading Singapore Pte. Ltd

KEFTS, a 100% subsidiary of Kansai Electric, was established as an LNG trading arm of Kansai Group in April 2017. KEFTS has been supporting Kasai Electric’s LNG supply-demand balance and providing LNG portfolio for customers around the globe, and now enhances its activity to support Kansai Group’s carbon neutrality at its base in Singapore.

About Hartree Partners

Hartree Partners, LP is a leading global energy and commodities firm with an international reputation for integrity developed over decades. Our expertise enables us to capitalise on the transition from fossil fuels to a low carbon economy. Hartree’s global breadth and reach provide a competitive presence in a comprehensive range of commodity markets, enriched by the firm’s employees who add deep insight, expertise and innovative thinking. More information concerning Hartree can be found at www.hartreepartners.com

About Vertree Partners

Vertree Partners enables leading companies and institutions to invest in both nature and innovative climate technologies to assist them in reaching their decarbonisation goals. Founded in 2020, Vertree is focused on driving positive environmental and social impact, and providing its customers access to existing and future supply of high-integrity environmental commodities. It does this through directly financing quality emissions reductions and removals projects; partnering with renowned project developers; investing in innovative organisations and technology-based solutions; and providing its expertise in voluntary and compliance markets, trading, market analytics and risk management. Vertree is wholly owned by Hartree Partners.