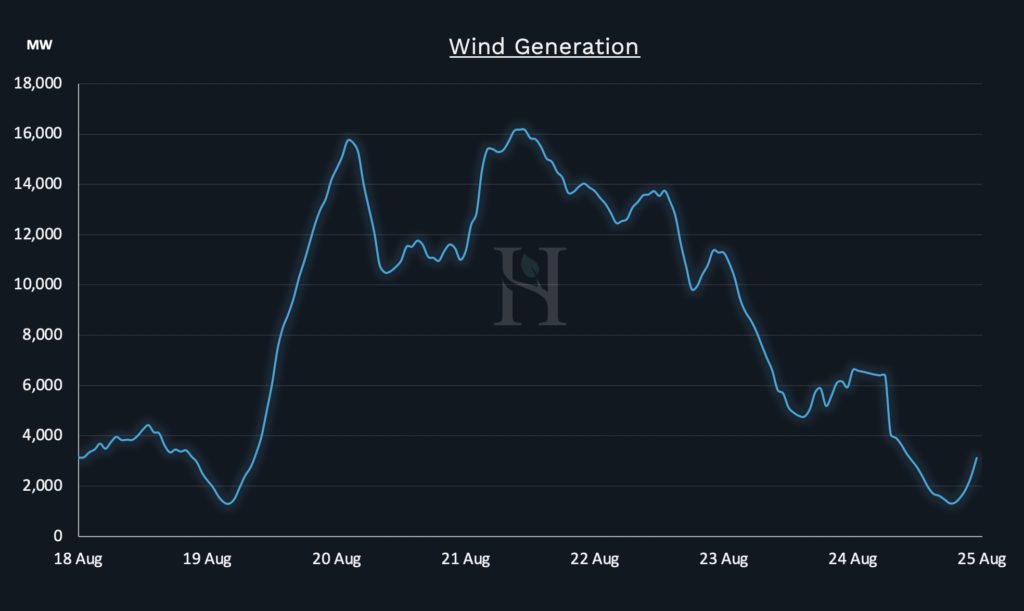

Since last week, as the weather forecast has become more certain, Hartree Solutions’ in-house models have been identifying potentially high system prices for today’s evening peak. This is, for the most part, a result of total unconstrained wind ramping down from a peak of 16GW to an expected forecast of 1.5GW.

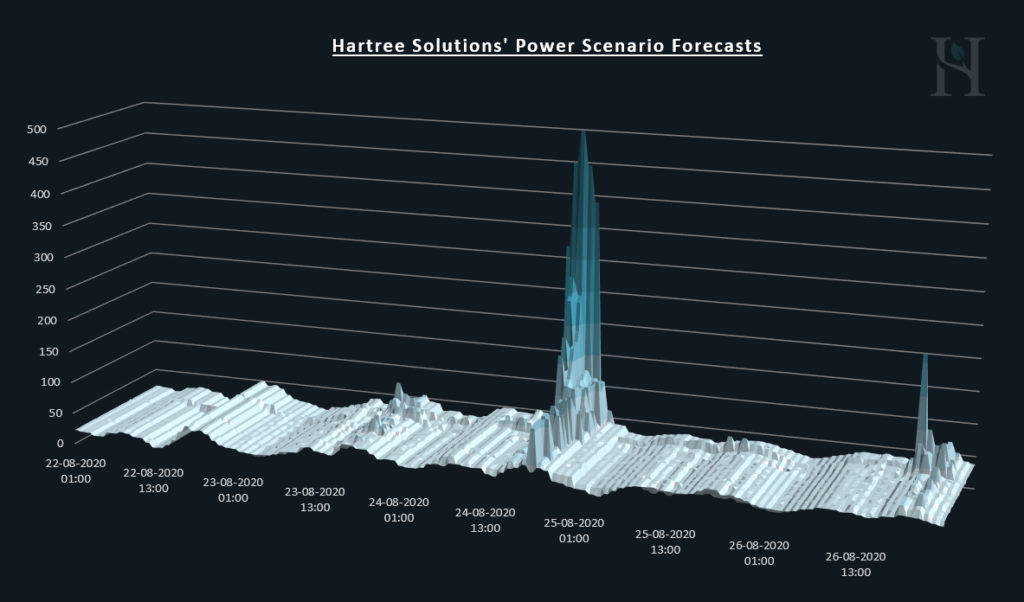

This observed tightness was evident in the Day-Ahead auction results as it cleared at the highest level since 3rd Dec 2019 with a baseload price of £48.86/MWh and Block 5 (the four hours starting from 3 PM) at £71/MWh. This potential system tightness can be observed in our scenario analysis as generated prior to the Day-Ahead auctions as shown below:

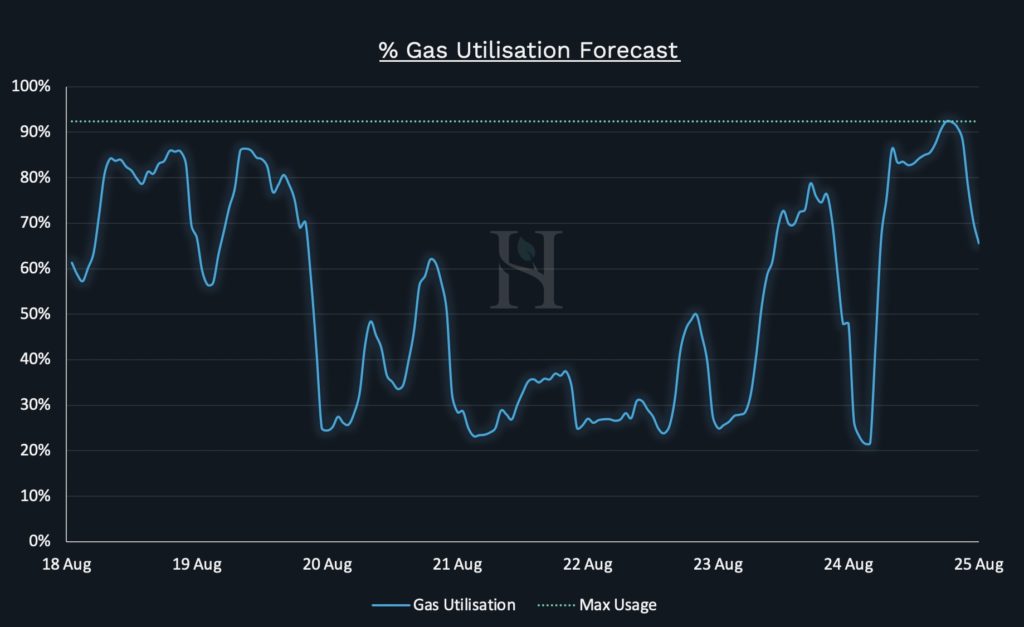

As wind turbines slow over the day, the requirement for thermal generation increases. We forecast almost all the available gas fleet to run, with station utilisation at 92%.

With the UK fully importing from France, Belgium & Netherlands via interconnectors, the remaining demand peak leaves little to no flexibility for the market and ultimately National Grid to balance the UK without looking further up the merit order to incentivise coal station running.

For this evening’s peak, the two key drivers of price action will be wind outturn relative to forecasts and spare thermal capacity which currently sits at just over 3GW. With the risk of power plants tripping, leaving them unable to generate, this margin could reduce even further. If either wind generation delivers lower than forecast or there are unscheduled power plant outages, then the market will be susceptible to high system prices as the balancing mechanism makes up this shortfall. Conversely, if wind generation remains higher than forecast for longer, then we will see National Grid bidding off plants in the Balancing Mechanism, suppressing system prices to some of the more mundane outturns shown in our scenario analysis.

There is further potential for a higher price response when we take into account the details of the imbalance pricing mechanism in the UK. If the low system margin remains then a pricing mechanism can come in to play, the Loss of Load Probability (LoLP), that reflects the probability of a shortfall of power generation to meet demand and thus blackouts. When National Grid activates one of its balancing tools, the Short-Term Operating Reserve (STOR), then these STOR volumes will be re-priced at the higher of their utilisation price or the Reserve Scarcity Price (RSP) of £6,000/MWh multiplied by the LoLP. This is the same pricing mechanism which helped set the latest high price record on 4th March this year when the system price hit £2,242/MWh triggered by a LoLP of 37% whilst STOR was in action (see Market Insight).

This morning, the system has had excess energy, and so National Grid has been bidding off more power than they have been offering on. This has led to low Cashout prices despite the strong auction yesterday. This large pricing delta from the auctions is largely due to wind out-turning 1.5GW higher than forecast plus Coal Power Stations running close to full-load to ensure it is warmed and ready to be offered on later tonight.

Last month, the UK’s coal-free generation streak came to an end after two months – the longest period since the industrial revolution. This record is in part down to lower power demand, as Covid-19 restrictions hamper travel, commerce and industry. As noted in our previous Market Insight post, we have seen a reduction in this effect as Covid-19 restrictions are loosened with demand returning close to pre-Covid-19 levels for both the morning and evening peaks. More recently, due to the hot weather, we have seen a boost in demand as air conditioning units power on.

As the UK moves away from coal generation and continues to rely on harder-to-forecast renewable generation, the UK is seeing a rise in power price volatility. By investing in decentralised local generation and utilising our market-leading power forecasting we can help protect our customers from the costs associated with this ever-increasing price volatility. This allows Hartree Solutions to guarantee our customers fixed long term power savings over anything else achievable in the market.

Mitch Hermens