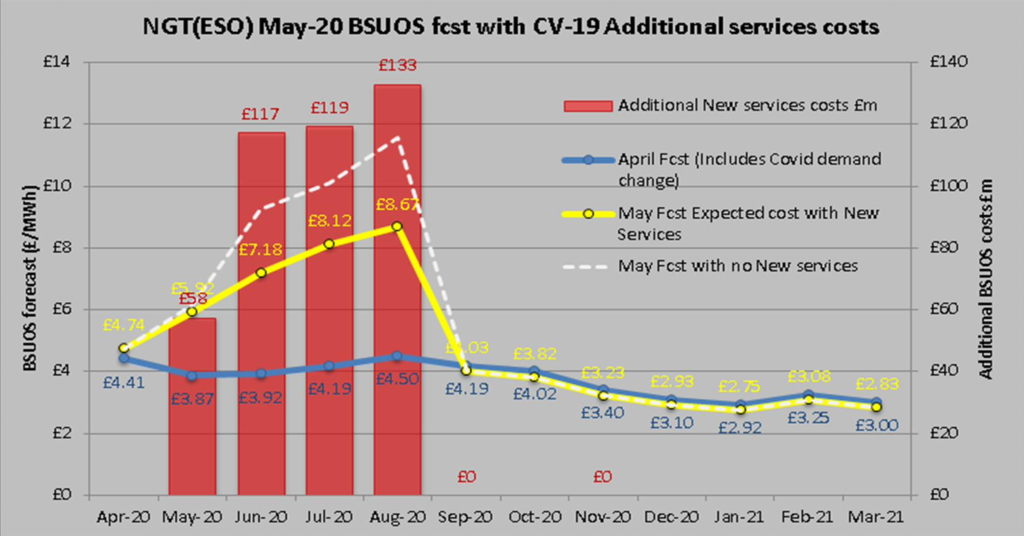

Covid-19 and lockdown has seen demand for electricity fall in Great Britain by up to 20%. National Grid, the electricity network operator who manages the electricity system, forecast that the low demand will cost them an additional £500 million in balancing the electricity transmission system.

The additional costs will be recovered through a charge known as Balancing Services Use of System charges (BSUoS) – which generators and end-users are liable for – set to be applied between June and August and an increase of around 90% on average.

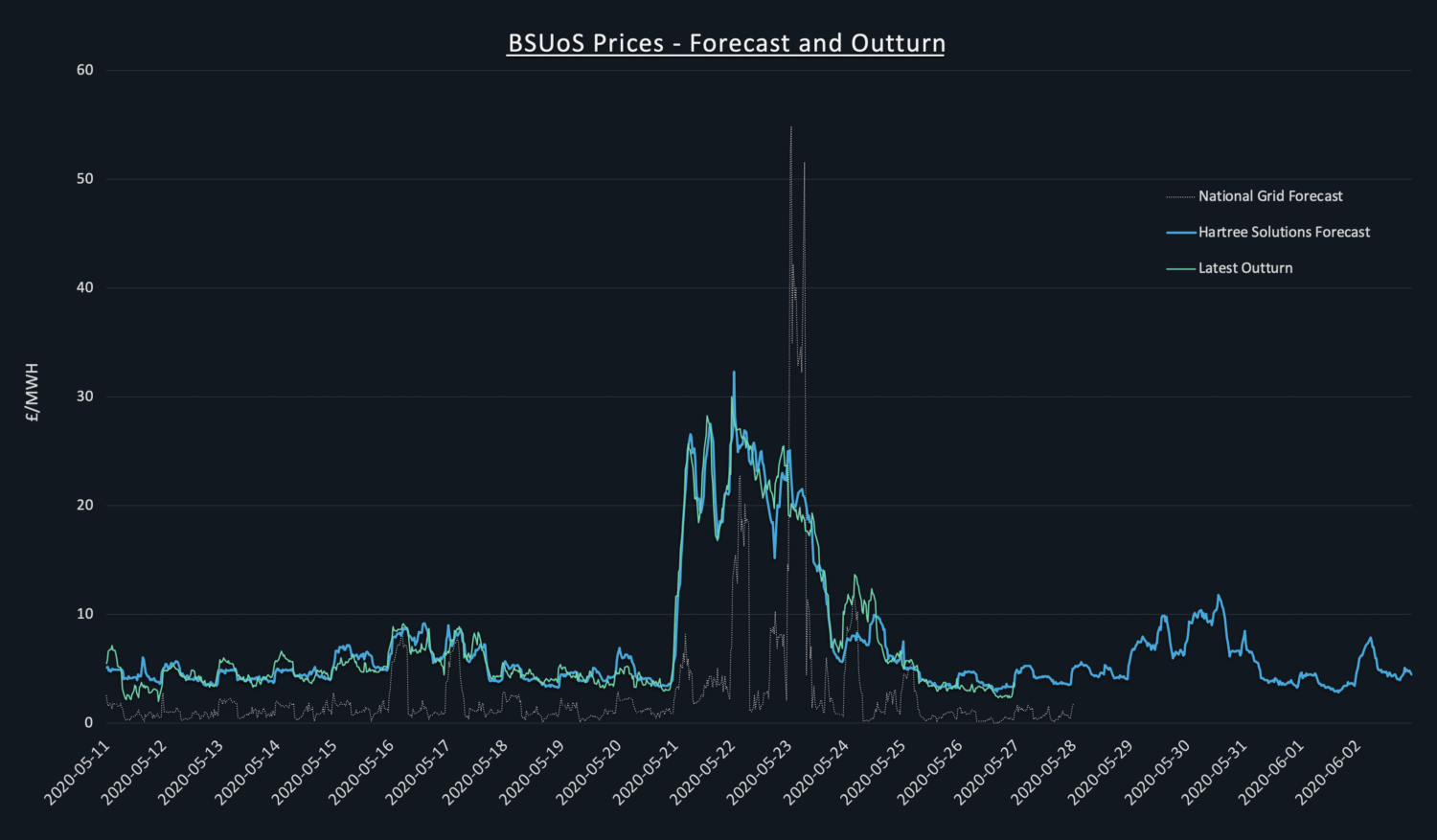

BSUoS costs are charged on a half-hourly basis and can range from £0-£20 an hour in a single day, dramatically changing the dispatch patterns of all generation and supply. Furthermore, the charges are only accurately reported around one month after delivery, making it even harder to forecast the real BSUoS cost of supplying as a generator or importing as an end-user.

What do additional BSUoS costs mean for electricity generators and consumers?

If you generate a large amount of electricity (typically 50MW and upwards) and connect to the national transmission system, you will be charged these increased costs per hour of generation. Therefore, your marginal costs will rise by an unknown amount and you will need to charge more for generation. This, in turn, will directly impact the wholesale price of power.

Generators that are connected to the distribution network lower down the system, rather than to the high voltage National Grid (also known as ‘embedded generators’), will be paid these BSUoS rates. Thus, the cost of generation will decrease.

For end-users, the cost of electricity will increase at an uncertain half-hourly cost. Depending on who supplies your electricity, some of this risk may sit with your supplier; especially if you have a fixed fee contract with them that includes assumed BSUoS costs vs higher BSUoS costs.

This is why some larger suppliers are attempting to defer the impact of BSUoS. They want to spread the cost of additional balancing during COVID-19 equally across all the settlement periods during 2021/22 to ease the pain the unprecedented charges could have on them.

In addition, OFGEM is currently consulting on whether BSUoS should be recovered on demand-only (and not with generators) so that we better align with Europe. This would see an increase in BSUoS costs for end-users but would be offset by an equivalent reduction in wholesale market prices. This in turn will impact the power that is flowing to and from Europe to the UK.

The benefit of being a Hartree client in light of BSUoS and Covid-19

For most businesses, there’s a divide between their energy supplier and their asset optimisation partner. Ultimately, this means that they do not benefit directly from the optimisation of assets, instead, the benefits flow to their current supplier.

Here at Hartree Solutions, we become your energy supplier and your optimisation partner so that you are the one who benefits. We pass additional revenues (like those highlighted in the chart below) to you directly or we guarantee you a long-term fixed power price discount. This gives your business savings and certainty that’s not offered elsewhere.

If you’d like to discuss a partnership with Hartree, please get in touch.

Brendan Mycock