-

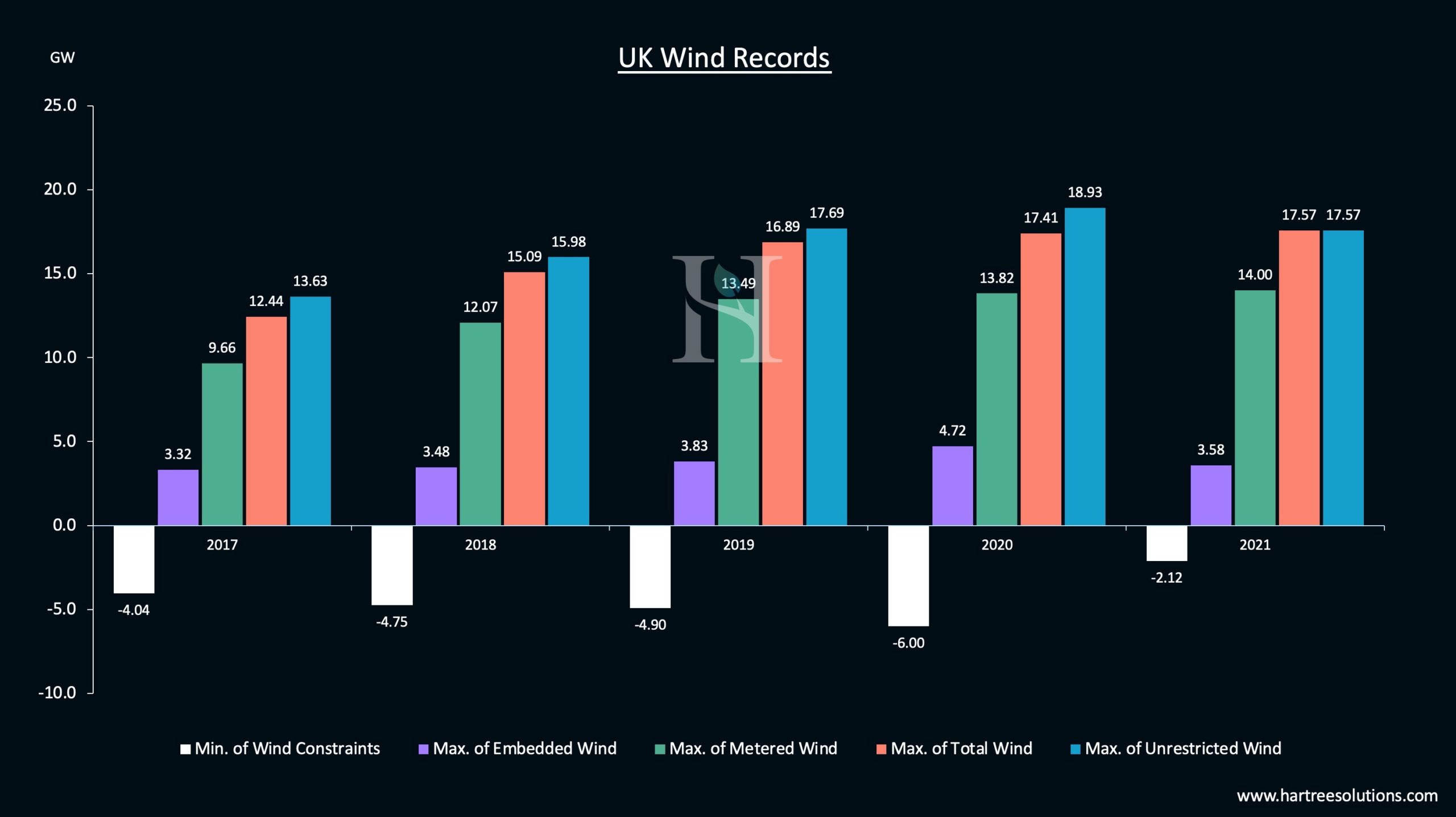

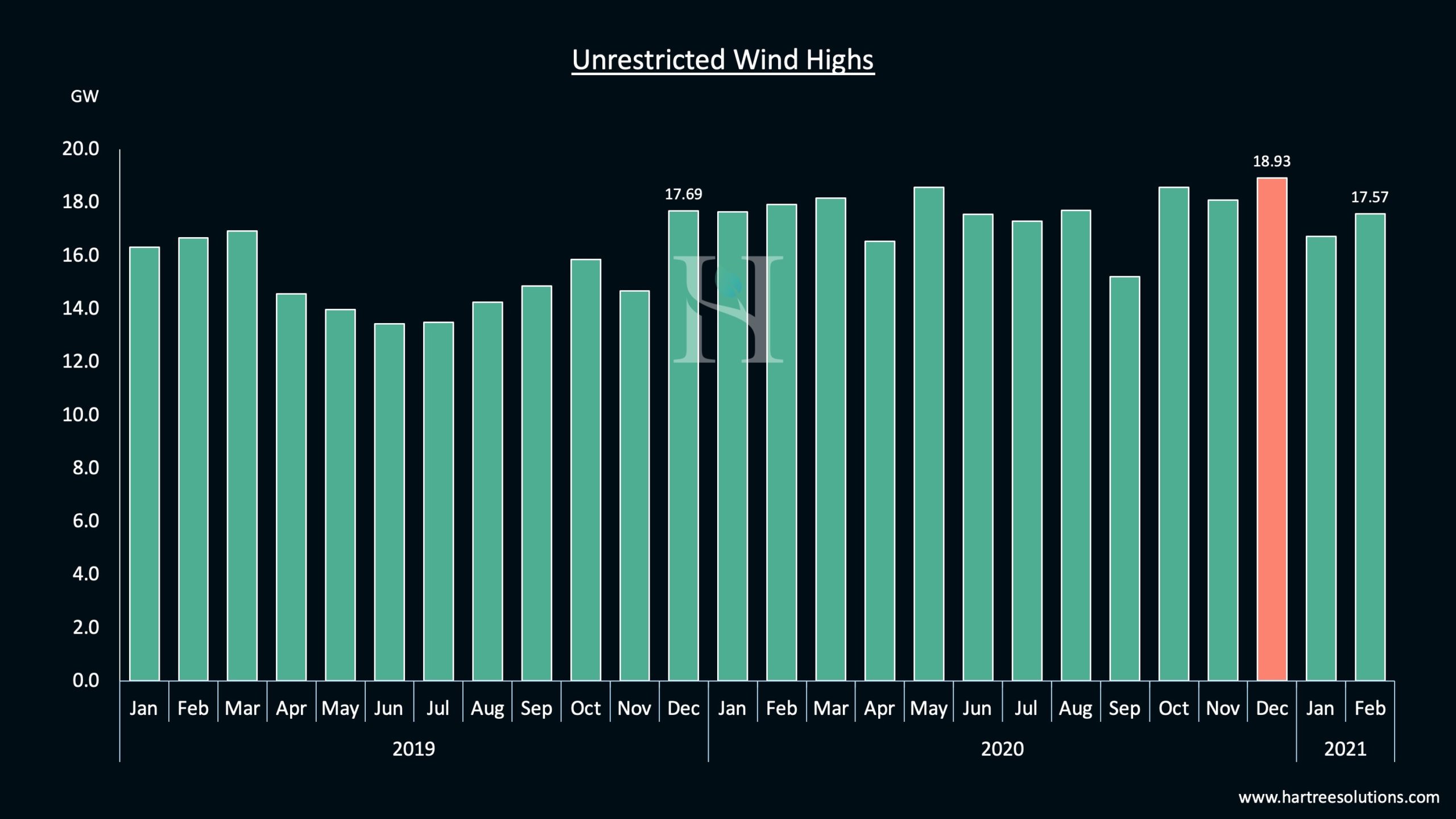

Wind generation sets a record high of just over 17.5GW, but this could have been achieved 14 months earlier if not for network constraints

-

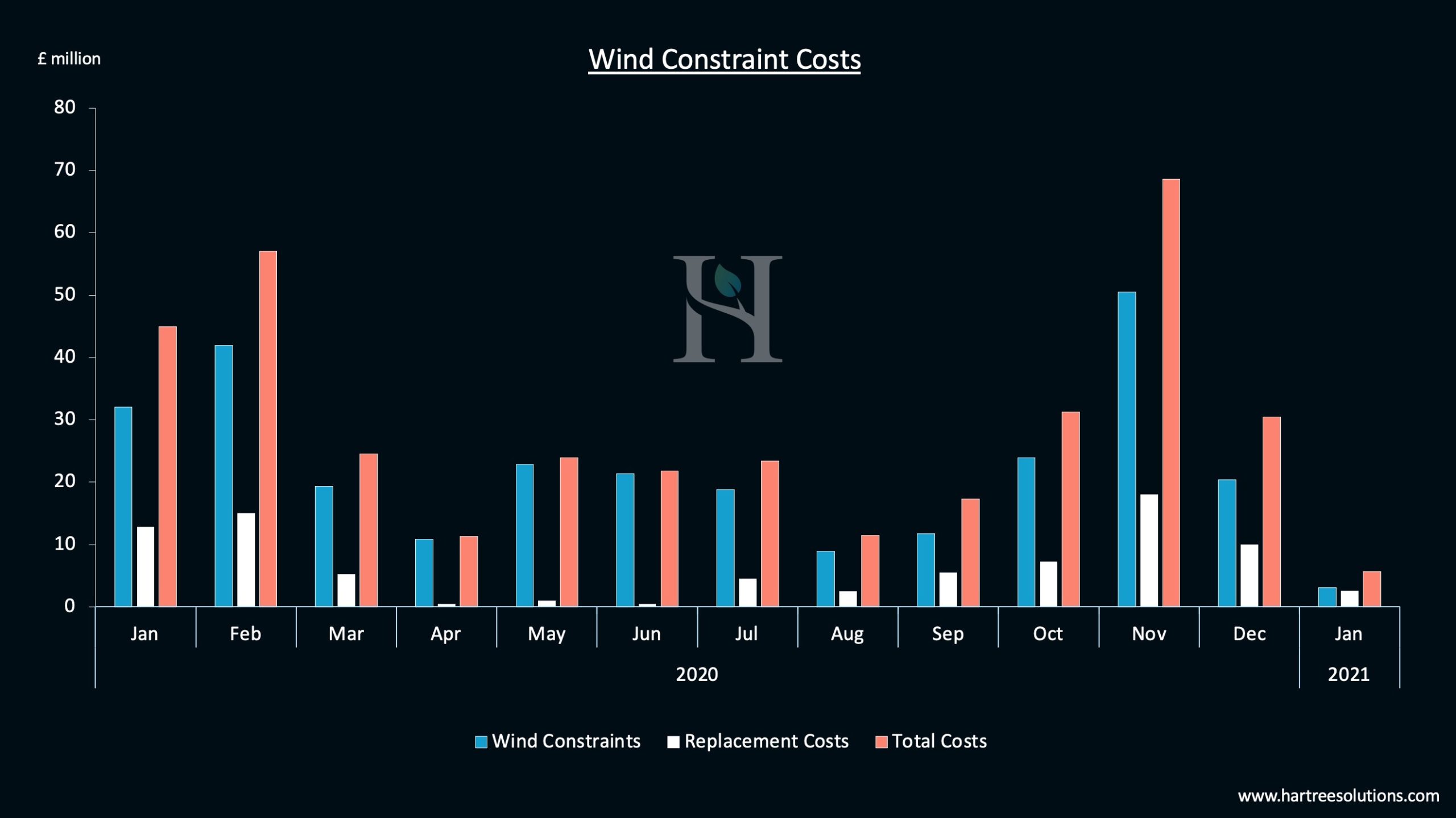

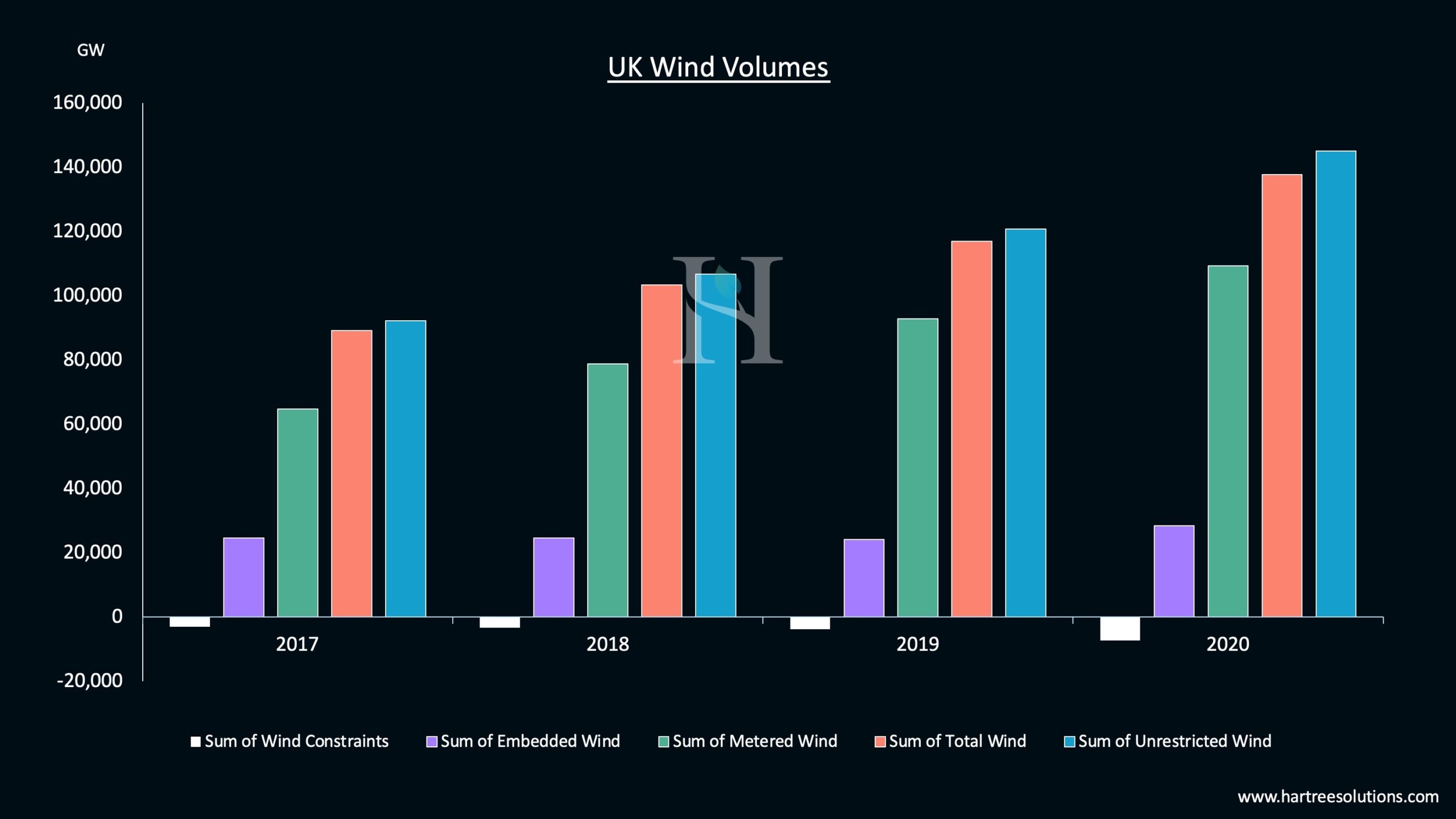

National Grid paid £283 million to wind farms last year to constrain supplies or 5% of the total volume generated by wind

-

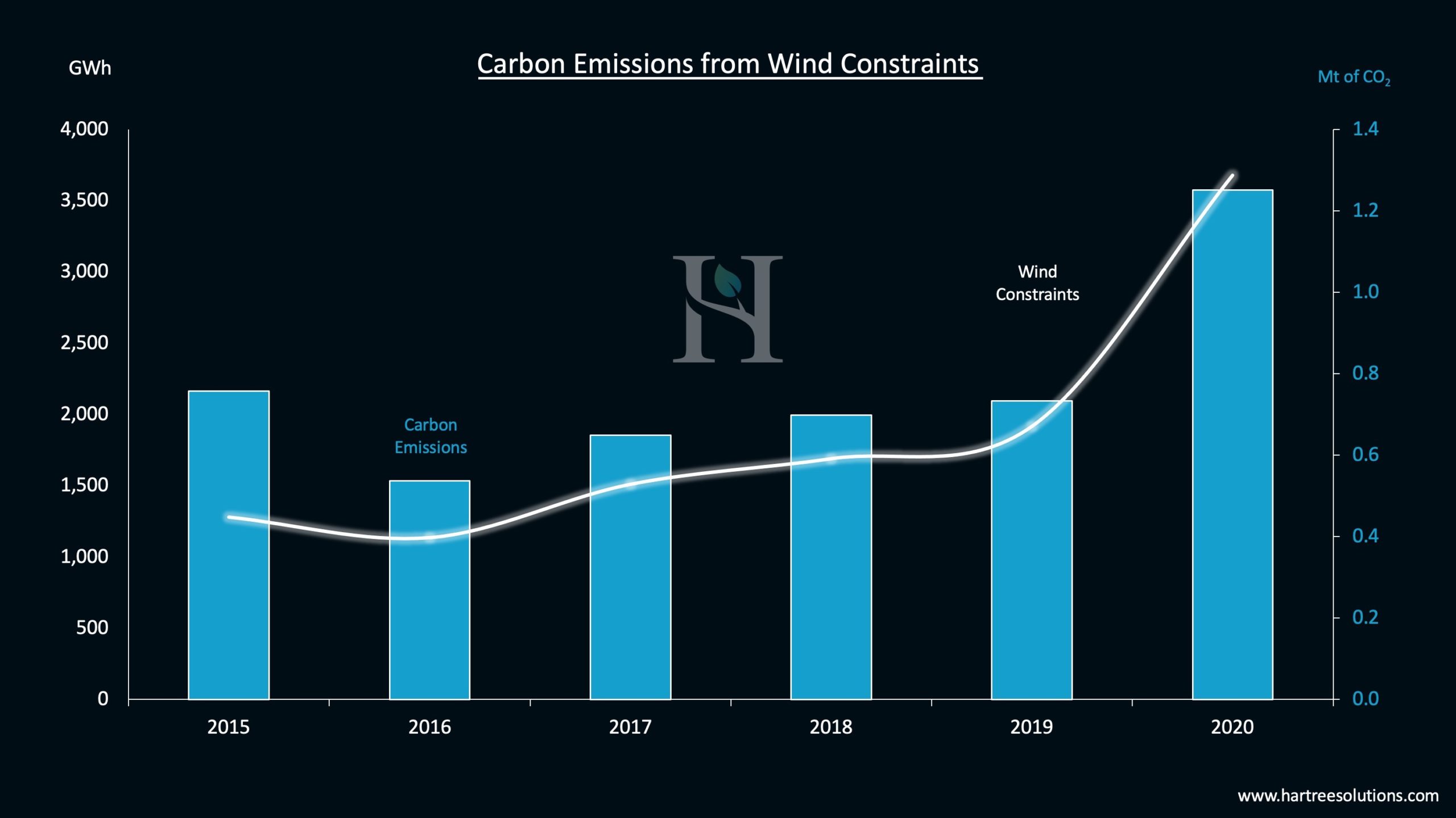

These curtailments cost an extra £83 million when replacement power is considered, as well as resulting in an additional 1.25 million tons of CO2 being emitted, or 2.7% of the UK’s total emissions from power generation

-

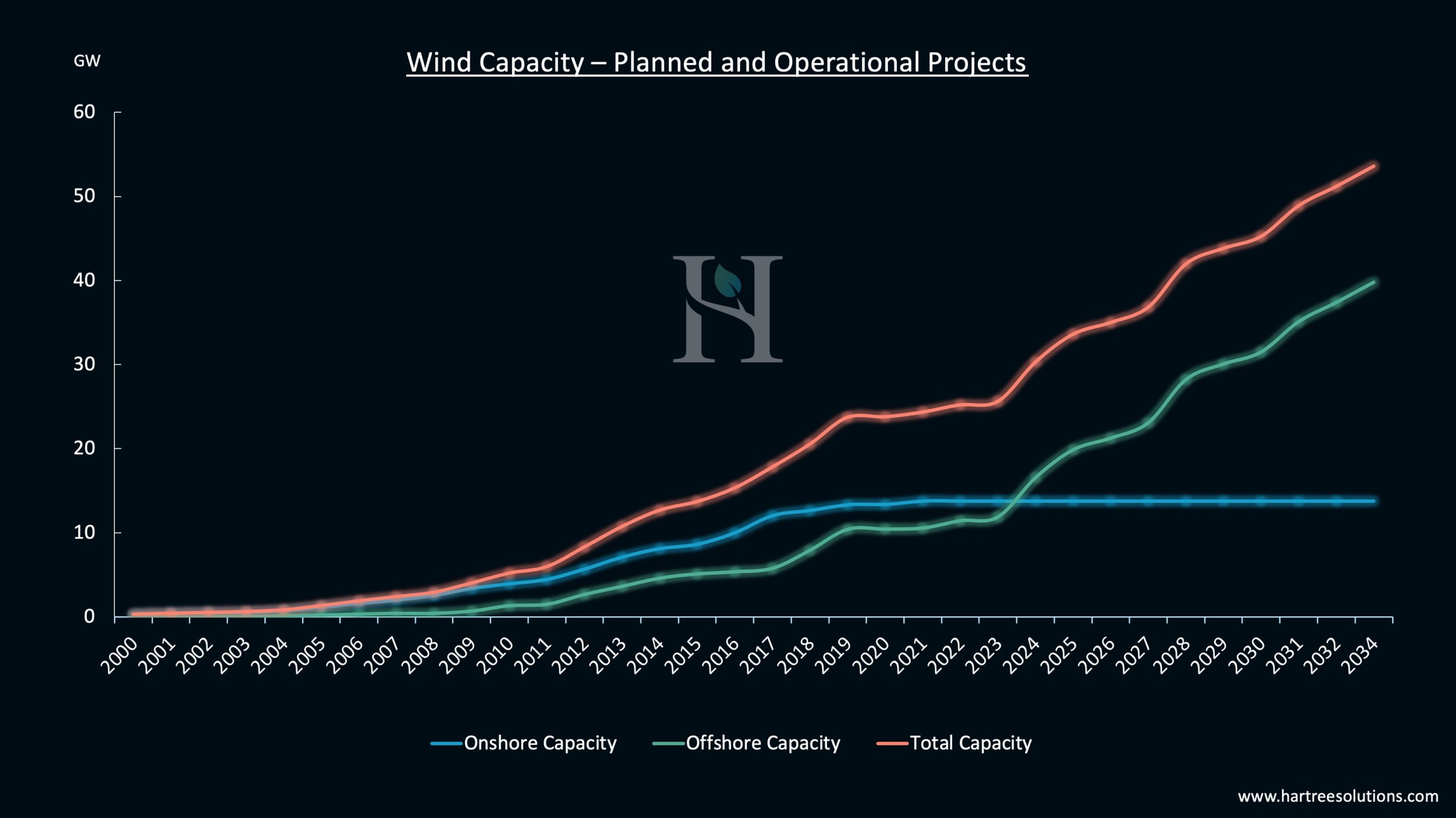

While the recent record shows the progress the UK is making, the country still needs to quadruple offshore wind capacity by 2030 if the ambitious target is to be achieved

New Highs

The UK achieved a notable milestone over the weekend, with wind generating a record high of just over 17.5GW. Impressive as this achievement is, it highlights the considerable work ahead to achieve the UK’s ambitious goal of 40GW of offshore wind capacity by 2030, nearly fourfold current levels.

The record was achieved thanks to a windy weekend with high demand. The latter is crucial because more wind power can be consumed locally to its source, thus reducing volumes necessary to be transported to higher demand areas.

At times of high winds, the National Grid frequently pays operators to curtail power as the network struggles to transport these vast wind volumes to demand areas. To reach the offshore wind target, significant investment is required in the network to ensure this new capacity can generate unconstrained.

By way of a live example, just a few days ago, the 2.2GW sub-sea HVDC Western Link cable, running between Western Scotland and North Wales, went offline1. This cable outage has added to an average wind curtailment of 1.7GW over the last three days. The same cable that Ofgem recently announced was under investigation around its ‘delivery and operation’.

Constraint Costs

Analysis by Hartree Solutions shows that the National Grid paid £283 million to wind farms last year to constrain their supplies, with the bulk of these extra costs being borne in the winter months when the wind is highest.

In addition, when these megawatts are constrained, they need to be replaced. This is often via thermal generation, resulting in the production of carbon dioxide (CO2) emissions at the expense of renewable generation. Our analysis shows that the additional cost of these replacement volumes was £83 million throughout 2020, resulting in a combined £366 million spend linked to wind constraints.

Just this week, National Grid stated:

“The cost of these constraint payments is continually weighed up against the cost of building new infrastructure, to ensure we keep the costs of running the system as low as possible. To date, these constraint payments have been the most cost-effective option to operate the electricity system securely.”

Whilst much of the £283 million paid to wind farms will be offset by reduced subsidy payments, this falls outside of National Grids considerations when investing in the network. If we take the National Grid’s statement at face value, combined with our analysis, we can conclude the cost of alleviating these constraints is more than the £366 million spent last year.

Higher Carbon

Further, through our marginal carbon analysis, we have calculated the effect these curtailments have on the UK’s emissions from power generation. Last year, the UK saw a 70% increase in CO2 emitted from these constraints. Further, we find the added emissions from curtailing wind and substituting the power, often with CO2 emitting sources, resulted in an additional 1.25 million tonnes (Mt) of CO2 produced, or 2.7% of the UK’s total emissions from generation in 2020. To put this into context, this equates to 211,000 homes’ electricity use for a year or, if we value these extra CO2 emissions at today’s EUA price1, just over £40 million. Valuing the emissions using this approach leads to a cost of £406 million associated with wind constraints.

We have previously highlighted the importance of analysing the carbon intensity of the marginal price-setting unit in the UK to achieve our net-zero goals and have called for carbon to be included, alongside price, when deciding which electricity sources are utilised.

14 Months Late

Without these constraints, the 17.5 GW milestone would have been achieved some 14 months earlier, on 8th December 2019. Had National Grid not constrained 4.1GW of wind generation, the UK would have produced 17.69GW of electricity from wind. Similarly, on boxing day last year, the UK would have set a record just short of 19GW without 2GW of constraints.

Whilst lower demand from Covid-19 drove an increase in constraints, there has been a steady increase in these annual volumes, which have almost doubled in the last year. In fact, throughout 2020, 5% of all wind generation volumes were curtailed due to network constraints.

A look Ahead

The wind is already proving to be a crucial part of the UK’s power networks, covering as much as 74% of total demand, a record set in the early hours on 26th August 2020. According to UK government data, wind accounted for just 2.7% of generation as recently as 2010. But with the wind making up 21% in 2020, the industry’s growth has been impressive.

While the Crown Estate’s recent auction was heavily oversubscribed, it highlights the continued investor appetite, with BP paying more than £900 million for the rights to build offshore wind farms in the Irish Sea.

All this investment should ensure that the UK can meet its 2030 capacity target from a development perspective. However, the more significant challenge is how to optimise this vast increase in wind generation and make the necessary investments in the network to avoid mounting constraints on its production.

This weekend was a hugely positive step forward in renewable generation for the UK, but it now needs to ensure there are no curtailments to continued progress.

Footnotes

1 As shown on National Grids Daily Balancing Reports

2 Dec ’21 EUA price as of 19.02.21

Adam Lewis