Whilst most businesses have the desire to go green, very few have a clear path and strategy to achieve that goal. There is no straightforward answer to this problem as what works for one business may not be suitable for another. The path to carbon zero is complex and uncertain but here at Hartree Solutions, our goal is to independently offer you clear, transparent and ethically sound solutions to achieve your target.

In an ideal world, your business would be located next to an unconstrained electricity connection, low-grade flat land with high annual sun hours, high wind speeds, no national or local planning constraints, visually not overlooked and not in a greenbelt zone. If you are lucky enough to be able to tick all these boxes and have access to unlimited capital over the long term, then the road to carbon zero is a simple one! For everyone else, the path is unclear at best.

At Hartree Solutions we have the capital, team and skillsets to offer you energy solutions that are achievable today that will enable you to meet your long-term carbon reduction targets.

In this article, we offer you an in-depth overview of carbon offsets. Not only are the savings they generate real and immediate, they are also permanent and do not lead to additional emissions elsewhere.

If you’d like to learn more about Hartree’s carbon offset solutions or have any questions regarding this article, please contact us.

Contact Us

What are carbon offsets?

Carbon offsets are defined as “a unit of CO2e that is reduced, avoided, or sequestered to compensate for emissions occurring elsewhere”.

Offsetting compensates for the emissions that polluters cannot avoid through internal measures by supporting projects that reduce emissions somewhere else.

Offsets are deployed in both compliance and voluntary markets. In the former, entities buy carbon offsets against a portion of their compliance obligation which sets out the total carbon dioxide they are permitted to emit. In the latter, entities can purchase carbon offsets to mitigate their greenhouse gas emissions (GHG) outside of compliance markets.

For a carbon offset to be issued, proposed projects must meet the following condition precedents:

- Baselines are the benchmark level of emissions that a project needs to outperform in order to issue carbon credits.

- Quantification of GHG emissions represents an accurate and precise measurement of GHG reductions and removals.

- Additionality relates to the requirement that emission reductions would not have happened without the incentive of carbon credits.

- Permanence is defined by the need for an emission reduction to represent a long-term mitigation benefit.

- Leakage reflects the requirement for the project to not increase emissions outside of its boundaries (due to a displaced activity).

- Independent verification of emission reductions proposed for certification as carbon offsets must be monitored, verified and approved by an authorised independent third-party.

How carbon offsets are created and certified

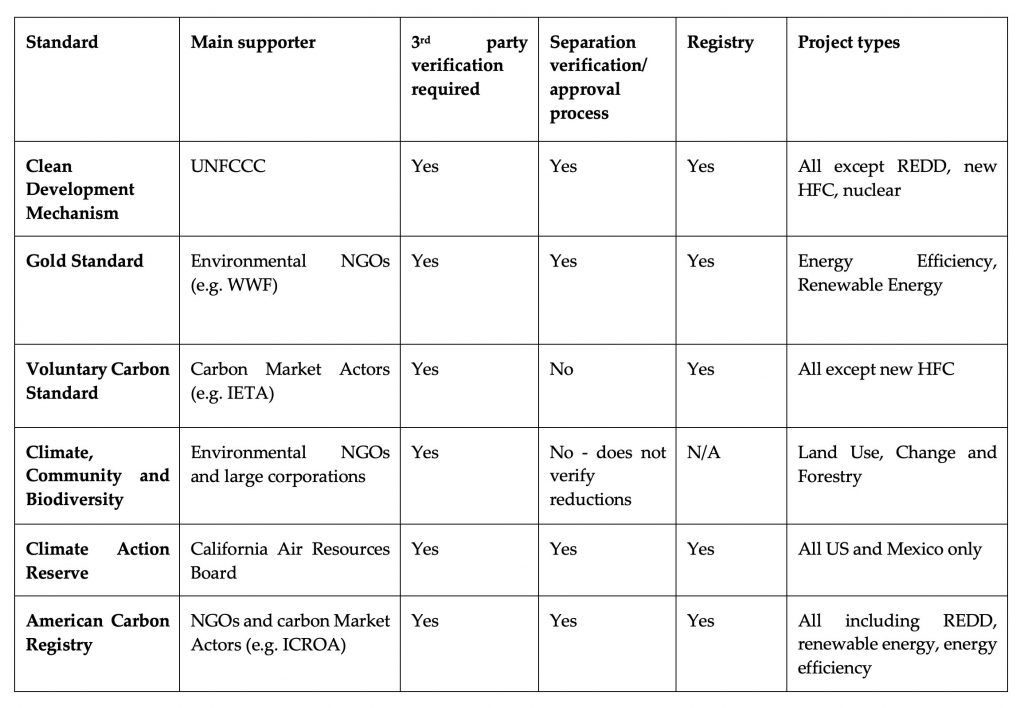

All projects supplied by Hartree must be certified and validated by recognised carbon standards such as the Verified Carbon Standard or Gold Standard. These standards establish a rigorous set of rules and requirements, as well as specific emission reduction quantification methodologies that set out specific parameters for measuring, accounting and monitoring impacts.

All projects supported by Hartree achieve certification by following the process below. The steps ensure that the projects are of high quality and deliver high impact environmental and social results and that the emission reductions and removals they generate are real, permanent, and additional.

Registering and certifying a project under a specific standard can take up to 2 years and is overseen by independent third-party validation and verification bodies (VVBs).

Learn more about the certification process.

The role of offsets as a transition tool

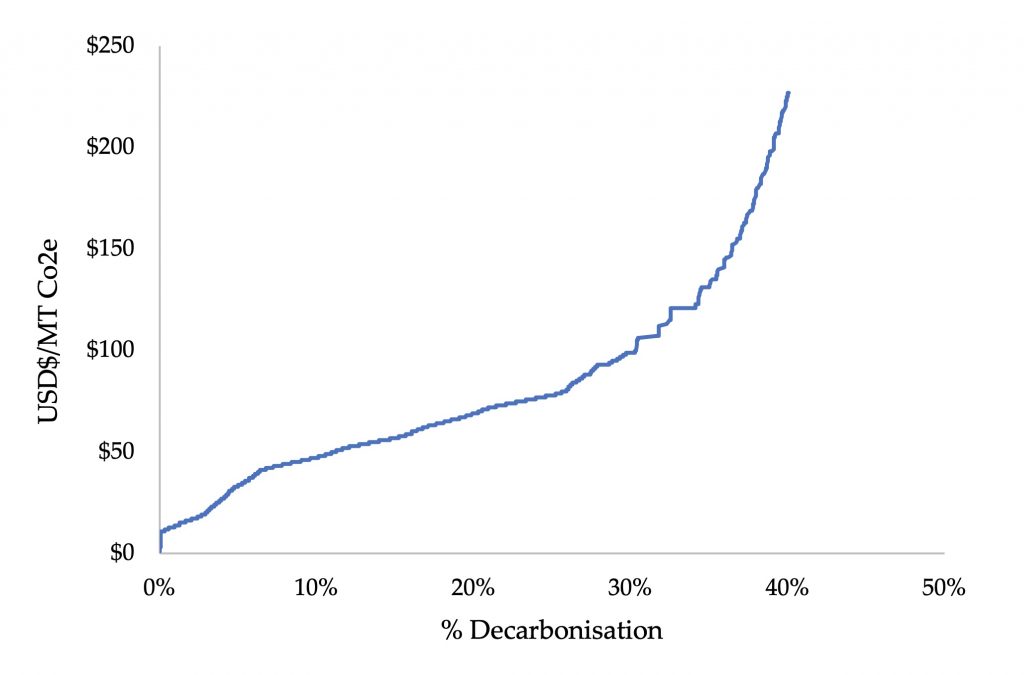

A Marginal Abatement Cost Curve (MACC) is a tool for presenting carbon emissions abatement options relative to a baseline (typically a business-as-usual pathway). It permits an easy to read visualisation of various mitigation options or measures organised by a single, understandable metric: the economic cost of emissions abatement.

The graph below represents the MACC in relation to the EU Emissions Trading Scheme. As can be seen from the chart, the more CO2 needs to be reduced, the more expensive it becomes to do so. A higher CO2 reduction target or a reduction in oversupply will, therefore, require higher CO2 prices to achieve the necessary reductions.

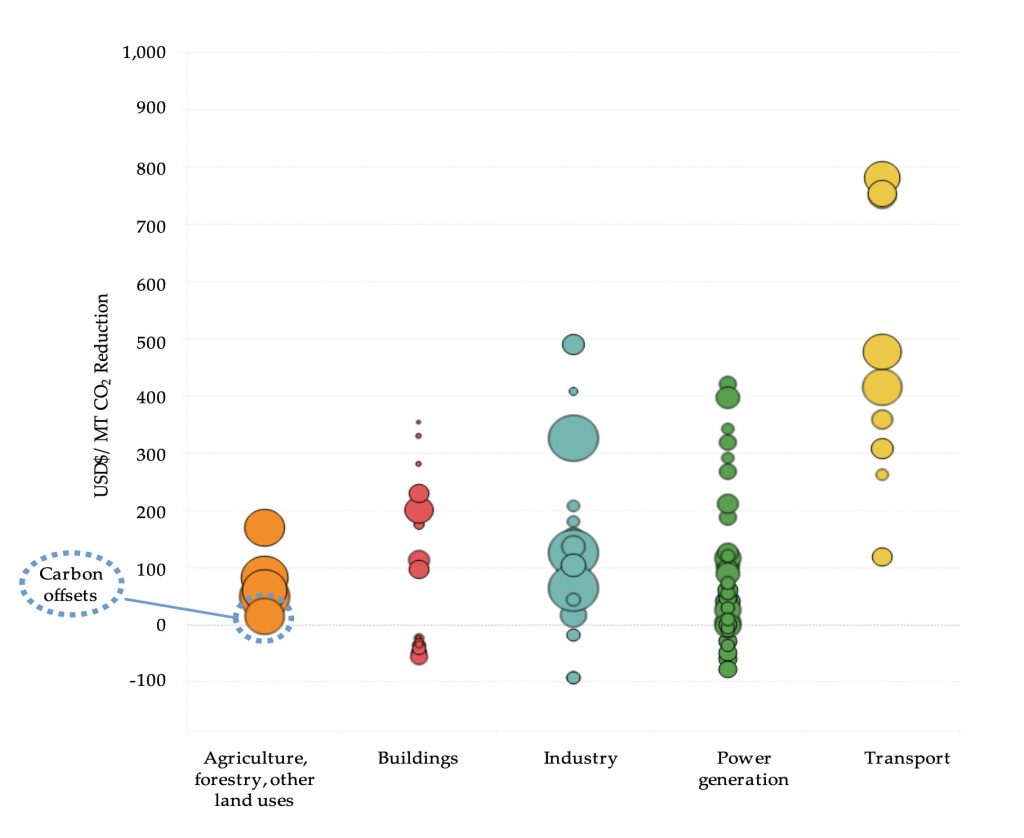

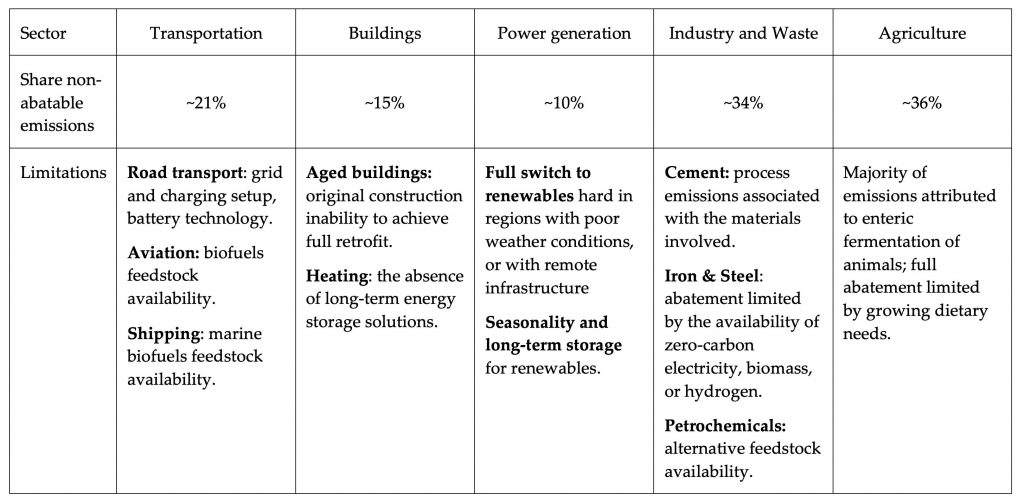

It is expected that as companies will gradually phase into lower-carbon technologies, the above sectors will rely on carbon offsets in the short to medium term, via voluntary markets or expansion of existing compliance markets.

Carbon offsets are not meant to substitute technological advancements in areas such as carbon capture, hydrogen or energy storage that can reduce carbon emissions in the long-term; they are also not intended to support emitters achieving their science-based targets (the climate targets that meet the goals of the Paris Agreement of limiting global warming to well below 2 degrees – explained in more detail below). Carbon offsets though are a vital, economic tool in the transition and decarbonisation of hard-to-abate sectors. They play a key role in sectors with high carbon intensities and a low transition pace given current commercially viable technologies.

Project types eligible to generate credits

Carbon credits can be produced from multiple approved project types:

- Agriculture, forestry and other land use (AFOLU)

- Energy (renewable/non-renewable)

- Energy distribution

- Energy demand

- Manufacturing industries (increase energy efficiency in production)

- Chemical industry

- Construction

- Transport

- Mining/mineral production

- Fugitive emissions – from fuels (solid, oil and gas)

- Solvents use

- Waste handling and disposal

- Livestock and manure management

Hartree believes that credits generated from AFOLU projects are the offset of choice for polluters globally. Credits generated through these projects provide emitters with the lowest cost, highest impact solution to decarbonising their business operations outside of compliance carbon markets.

These projects protect at-risk environments, biodiversity, create jobs for local communities, and ensure that the emission reductions are real.

Institutions not currently governed by compliance carbon markets are turning to forestry credits as their primary solution to offsetting. They ensure the offsetting of carbon emissions by protecting native forests against deforestation and degradation.

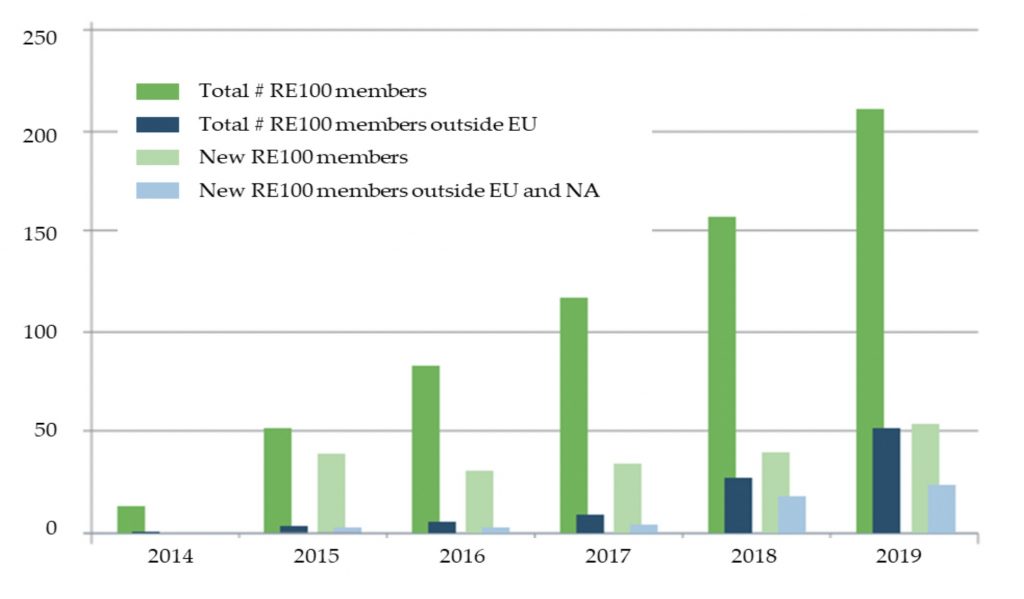

Committing to act against climate change

2019 was the year of climate change, with consumers all over the world taking a more active role and pushing for environmental and social action. Studies have shown that consumers are prepared to change their habits, reduce their environmental impact, and put pressure on companies to adopt a more socially and environmentally responsible behaviour. This has also meant that responsible investment has been demanded by a greater number of people and at a larger scale than ever before. Investors have been increasingly applying non-financial factors into their investment analysis and more often than not supply chains are feeling end-user pressure to demonstrate their sustainability policy.

There are several initiatives in place that require participating companies to commit to a path towards decarbonisation.

What are the differences between carbon offsets and renewable energy credits?

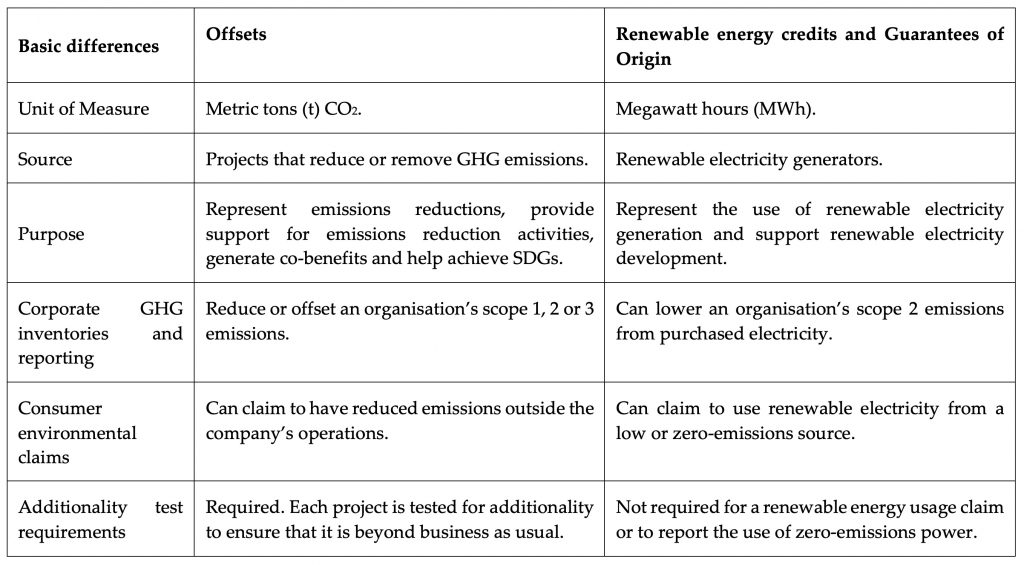

As can be seen from the table below, the major differences between offsets and renewable energy credits (RECs) lie in their purpose and element of additionality.

Firstly, given the nature of the projects that generate carbon offsets, especially those in the AFOLU category, offsets can generate co-benefits that align with other aspects of sustainable development, such as promoting gender equality, supporting local communities, job creation, water supply management and biodiversity protection etc. For example, the local neighbouring communities of a project area can re-invest the funds generated from the sale of offsets into the development of schools and medical centres, water and sanitation infrastructures, or use them to organise training around sustainable agriculture. These investments will increase the livelihoods and independence of the local communities, which will ultimately benefit the project in the long-term.

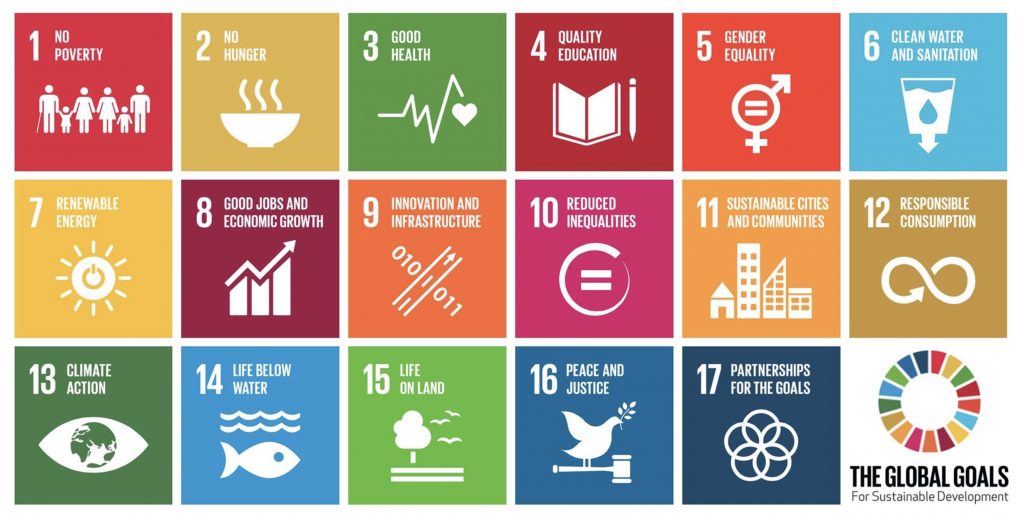

Several standards either incorporate such co-benefits in their requirements or offer add-on certifications that measure them. Most of the project developers and standards have begun matching these co-benefits metrics with the United Nations’ Sustainable Development Goals (SDGs) which range from ending hunger to providing access to energy and conserving marine life.

The UN Sustainable Development Goals

Looking specifically at the goals below, by reducing carbon emissions through the purchase of offsets, companies are working towards achieving SDGs 9, 11 and 13. Moreover, funds raised from offsets can support project developers to implement, roll out and invest in clean energy projects from which local communities benefit too, essentially supporting SDG 1,2,3,5 and 6. Project developers with projects generating offsets publish all their third party monitoring and verification reports highlighting achieved co-benefits on registry databases such as VERRA.

With RECs, on the other hand, purchasers are pairing emissions reductions with renewable, emissions-free electricity generation with electricity usage and its associated emissions profile. Renewable projects generating RECs are more limited in scope and their success relies solely on their ability to generate electricity which in turn displaces fossil fuel generation.

Offsets face strict rules for certification, including the requirement that the emission reduction credit is real, permanent, and most importantly, additional to a business-as-usual scenario. This “additionality” requirement is central to ensuring that the ton used as an offset is fully equivalent to the ton emitted in its place. Tests include legal/regulatory, financial, barriers, common practice and performance tests. The combination of tests that is best suited to demonstrate additionality depends on the type of the project.

In contrast, RECs are not typically held to additionality standards, and therefore can be supplied from renewable resources that are business as usual, or only partially additional to a ‘business as usual’ scenario. As renewable energy becomes cheaper than traditional sources of electricity, installing renewables and buying RECs and GOs will no longer pass the additionality test for corporates, developers and institutions looking to achieve net carbon neutrality.

Examples of companies that have already committed to using offsets over the last few years are listed below. Contact Hartree Solutions to add your company to this list.

Footnotes

Ariel Perez