After the transition period last year, the UK lost access to the EU’s Emissions Trading Scheme (ETS), and in its place, the UK created its own, almost identical ETS.

Next week, on 19th May 2021, the first UK ETS auction will establish a price for this new carbon contract.

As part of this series of articles, we’ll look at the impact two different schemes on the same continent has and why the longer the two ETS schemes are left separate, the greater the risk of irredeemable divergence becomes.

-

There is a significant risk that UKAs are mispriced in next weeks’ auction

-

Yesterday, the UK published the final free industry allocations for 2021-25, representing an 9 Mt annual decrease

-

Continued uncertainty remains over a linkage to the EU ETS scheme and is unlikely to be resolved this year

-

Decarbonising the industrial sector does not begin to occur until the UK ETS price reaches £50-60 ton

Where are we now?

After having considered a Carbon Emissions Tax and remaining a part of the EU’s ETS, the UK decided to launch the UK ETS, which came into effect at the start of this year. The scheme operates under the same principle as the EU’s version and covers the same sectors (electricity and heat generation, heavy industry and aviation).

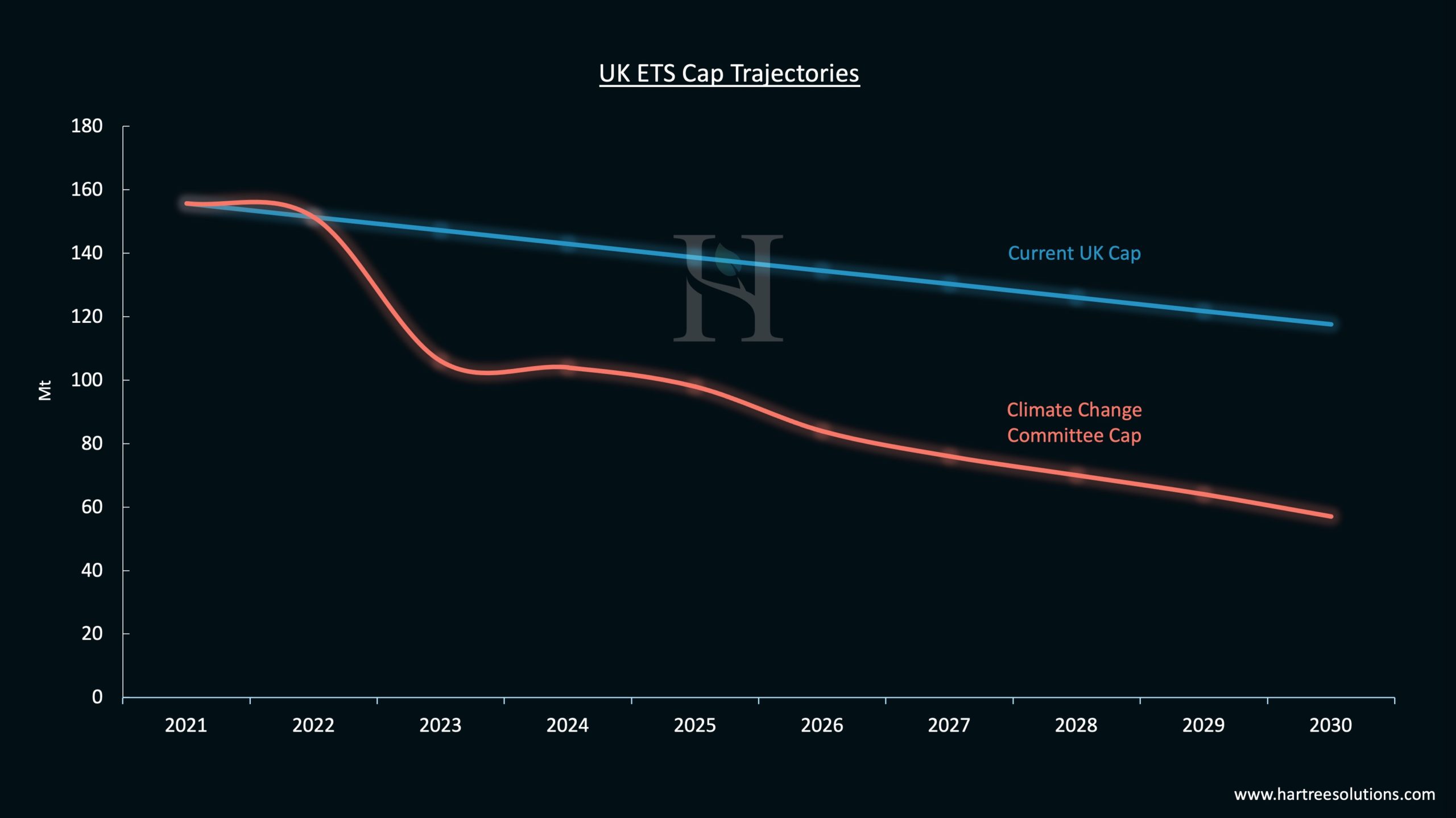

The UK ETS was initially planned to start with a cap of 155.7 Mt for 2021, falling to 117.6 Mt by 2030, figures which are 5% lower than the UK’s notional share of the overall EU ETS cap, which was based on a 40% emissions reduction from 1990 levels by 2030. However, the UK’s cap will have to be amended to keep it in line with the government’s newly announced target of cutting emissions by 78% by 2035, compared with 1990 levels.

In its Sixth Carbon Budget report published in December 2020, the Climate Change Committee suggested that the UK reduce the ETS cap starting 2023. While the exact trajectory is still to be defined, the UK government stated the CCCs report would play a key role in determining the trajectory of this new net-zero aligned cap.

The Free Allocation process is identical to the EU ETS, at least in the first two years, as is the auction process except for the addition of an Auction Reserve Price, or price floor, of £22. The UK’s Cost Containment Mechanism is almost the same as its European counterpart but acts over a shorter timeframe in the first two years to protect against excessive price volatility.

On 10 May, the UK published the final free industry allocations for the 2021-25 period using the same benchmarks used by the EU ETS. The allocations amount to a yearly average of 39.1 Mt over the five years. These represent an 9 Mt annual decrease from 2020 allocations to UK installations under the EU ETS (48.1 Mt).

Yet while the two schemes are currently similar, last months’ announcement by the UK of “the world’s most ambitious climate change target” points to the direction the country is seeking to go. Therefore, the UK is likely to favour more stringent measures for its own ETS and expand the comparatively narrow range of industries covered by it.

That said, any changes are unlikely to be implemented any time soon. This year and next are likely to see “business as usual” to allow the new scheme to bed in and minimise disruption and uncertainty for participants.

What’s next?

After this initial settling period is over, the most likely options are either the EU and UK ETS combine once again, or that the UK takes advantage of its independence and carves out its own mark with its recent record on climate pointing to a tighter system. If the two schemes were to combine, then the UK version would likely be consumed by the EU one, and there would be price parity. In contrast, a standalone climate-ambitious UK scheme could see a noticeable gap open up, with the UK ETS trading at a premium to the EU ETS.

Linkage- the attractions and the hurdles

The possibility of linking the two schemes has been on the table ever since the EU-UK Trade and Co-operation Agreement (the TCA) committed both parties to co-operate on carbon pricing. But while the TCA document states that linkage will be “given serious consideration”, the UK government was more hesitant in its White Paper. Instead, saying that while it was “open to linking the UK ETS internationally in principle”, it had made “no decision on our preferred linking partners”.

Given the similarities between the two schemes currently, it makes sense for any linkage to occur sooner rather than later while they bear such close similarity. However, the UK’s new 78% target shows how quickly differences can occur. Meanwhile, across the Channel, European Commission President Ursula von der Leyen announced that the EU’s ETS is expanded to include building and transport industries. While there are clear advantages to having a unified, jointly ambitious emissions trading scheme, progress on linking them has been slow so far, with many issues still needing to be ironed out.

The coronavirus pandemic has pushed all other concerns down the “priority” list on both sides of the channel. And amidst all the niggles that need resolving, as the UK and the EU adjust to a post-Brexit environment, the ETS is unlikely to be a top priority.

In addition, the UK’s scheme was hit by delays as market participants waited for government announcements on when the first auction would be held and the volume of carbon credits that would be available for free. Such was the lack of clarity that SSE, one of the UK’s biggest power producers, temporarily suspended its forward hedging and instead chose to commit generation much nearer to delivery.

The slow start means that any linkage agreement, which is most people’s favoured option, is unlikely to happen this year, despite the obvious attraction of making such an announcement at this autumn’s COP26, which the UK is hosting in Glasgow.

What does this mean for the market?

The uncertainty over the long-term future of the independent UK ETS has left participants facing a dilemma ahead of the government’s first auction of carbon allowances next week. With the scheme starting from scratch, there are no previous trades on UK Allowances (UKA), and so the EU ETS is likely to form the basis of the initial price discovery.

As a result, participating companies will have to form a fundamental view on the UK ETS, using the EU scheme as a benchmark and price their hedging requirements accordingly.

That said, we believe there remains a significant risk of UKAs being mispriced, with utilities and their hedging obligations potentially caught off guard and forced to convert their hedges at prices that diverge from that of the EU ETS. It also complicates the path towards decarbonisation (both from an industrial and utility point of view), as the key for cap-and-trade systems is price signalling. A lack of a clear price signal will likely delay investment decisions from big industrial users – the key target for the next step in the UK’s decarbonisation efforts.

While the UK has made great strides in decarbonising its power system, heavy industry still lags. The relatively easy switches achieved by the power sector prove harder to replicate elsewhere.

Pricing UK Emissions

A critical factor in power emissions more than halving over the last decade has been the introduction of the Carbon Price Support, a domestic top-up tax levied in addition to the EU’s carbon price. This experience demonstrates that putting a cost on carbon is successful in reducing emissions. Therefore, the success of the UK ETS is a critical component if the country is to achieve its increasingly ambitious targets.

Hartree Solutions’ analysis shows that decarbonising the industrial sector does not begin to occur until the UK ETS price reaches £50-60 ton, with many industries requiring much higher levels than this.

How can Hartree Solutions help?

First of all, any company wanting to participate in the upcoming auctions will need to ensure that it is fully compliant with the UK ETS Order. An entity that is or becomes subject to UK ETS Order should speak to its Legal or Compliance Departments to ensure compliance with its provisions.

Once an ‘Operator Holding Account’ (OHA) or an ‘Aircraft Operator Holding Account’ (AOHA) at the UK ETS registry has been set up (a process that can take up to two months), Hartree’s team of experts can help manage the risks mentioned above. We can help companies navigate the uncertainty that is likely to be a feature of the UK ETS.

Emissions trading will be a vital tool for companies seeking to achieve zero-emission goals. The sooner they familiarise themselves and find the right partners to work with them, the greater the long-term gains. For more information on Hartree Solutions and see if they are the right partner for your business, go to https://www.hartreesolutions.com/.

Coming up…

In Part 4 of this in-depth look at Carbon in UK Power, we’ll delve deeper into the UK ETS and present Hartree Solutions’ fundamental outlook. Among the key variables determining our view is the overall breakdown of the cap, the free industry allocations and utilities’ hedging programs.

Michele Lewis